By Laura Putnam-Ladley, Compliance Content Manager, Global Trade Intelligence, Descartes Systems Group

There has been no larger rippling effect in international trade than the United States’ use of Section 232 tariffs to protect domestic steel and aluminum production. The consequences have been far reaching and have resulted in a wide range of retaliatory tariffs on products, as well as raw materials. The result is a complex layering of tariff remedies and exceptions that looks like something a contestant might present on the “Great British Baking Show”.

Clarifying the Impact

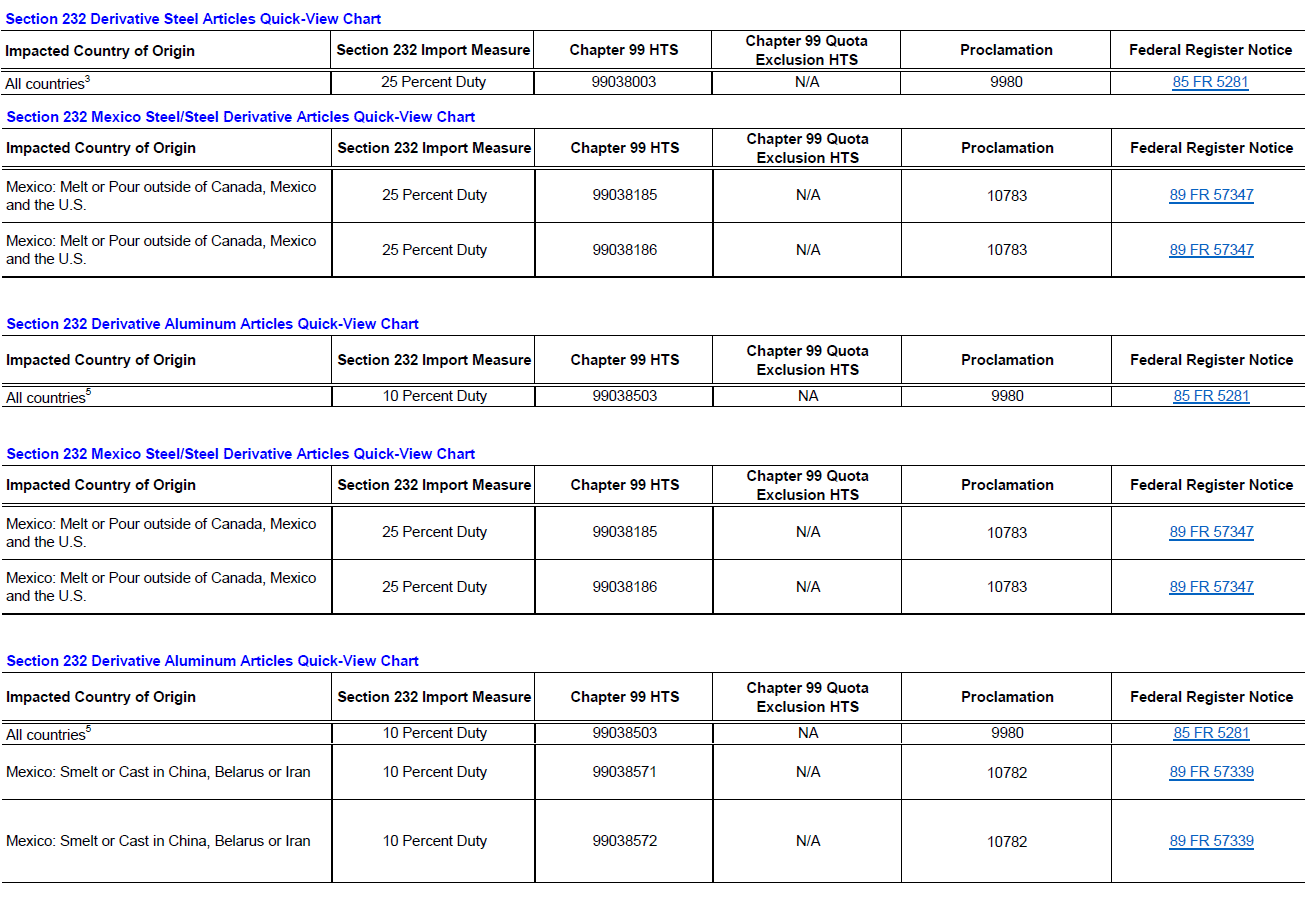

Navigating these recent developments has been challenging for importers. CBP has sent a quick-view chart for importers to use to help determine if a duty rate or an exception applies. However, it does not show the applicable codes in Harmonized Tariff Schedule of the United States (HTSUS) Chapters 72 or 73, only the corresponding Chapter 99 HTS codes for each country. The criteria for the exceptions are also not entirely clear. For example, the U.S. has extended the temporary exemption for Ukraine for another year, but it only applies if there is a certification of that shows the steel or steel derivative products are melted and poured in Ukraine.

For steel and derivative products from Mexico, the United States-Mexico-Canada Agreement (USMCA) certificate of origin is not enough to be exempted from the Section 232 tariff. There is an additional melt and pour requirement for imports of steel and derivative steel for products of Mexico to qualify for the exemption. These items must be melted and poured in the U.S., Canada, or Mexico. A steel mill certificate is required, even if the exemption is not claimed.

Fig 1. Duty Exemption/Exclusion Layers – Quota Exclusion, Product Exclusion In ACE (PEI) and Country Exclusion

How Section 232 Impacts Sanction Programs

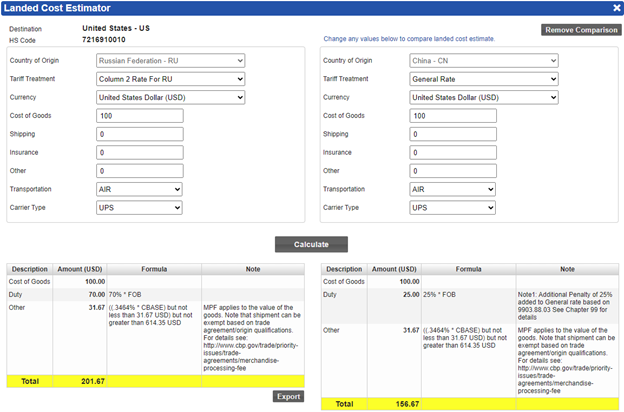

The tariff remedies section of Section 232 duties consists of many different penalty tariffs. To start, there are the column 2 duty rates reserved for Cuba, North Korea, and Russia. The normal duty rate for steel products is zero. However, if you look at the column 2 duty rate reserved for Cuba, North Korea and Russia in Chapter 72, there are many HS codes that show 20% for general duty and another 25% for the steel tariff for a total of 45%. One example (see figure 2 below) shows a more extreme example of 70% for Russia and 25% for China because of Section 301 duties (Duties implemented by the U.S. to address unfair trade practices by the Chinese government and use retaliatory tariffs to target products originating from China).

Fig 2. Compounded duty rates for high-risk countries

There are additional penalty tariffs which incorporate the Russia/Belarus, and Iran sanctions (see figure 3 below). The U.S. Bureau of Industry and Security (BIS) has increased export controls in these areas by focusing on evasive procurement strategies of these sanctioned countries, such as “layering procurements through third party countries to obfuscate the end user.” The Section 232 penalty tariff rates range from 10% to 200% for third-country processed items with inputs from these sanctioned countries. For aluminum and aluminum derivatives, it is a whopping 200% if imported from Russia or smelt or cast in Russia.

Fig 3. Penalty Layers – Ranges from 10% to 200% in Duty

One key location that is considered a transshipment country of concern for evading sanctions on Russia is Mexico, a USMCA country. The penalty rate for Mexico imports of aluminum and aluminum derivatives is ten percent if smelt or cast in Belarus, China, or Iran, plus the general duty rate. Additionally, there is a 25% penalty duty rate applied to imports from Mexico that include steel or steel derivatives melted or poured in a country other than the U.S., Canada, or Mexico.

Things to Consider

If your company imports steel or aluminum products, here are important factors you need to consider:

- Does your company qualify for a duty exemption or exclusion?

- Are you importing from a country with a quota-based exclusion? Check to see if the quarterly quota or annual quota has been surpassed.

- Are you importing from a country that qualifies for a PEI exclusion?

- Look to see if the HS code of your product is still eligible. There is a weekly update provided by Customs and Border Protection (CBP) on the PEI exclusions.

- See if your product meets the qualification criteria for the PEI exclusion.

- Are you importing from Ukraine?

- Verify the exemption is still in place.

- Make sure your product is eligible for duty free treatment under Section 232 with the specified country of origin document submitted with each shipment.

- Does your company import aluminum and aluminum derivatives from Russia or any other countries, that are smelt or cast in Russia, or import aluminum and aluminum derivatives from Mexico that are smelt or cast in any of the other geopolitical hot spots (Belarus, China, Russia, or Iran)?

- Consult with your procurement department to ensure that the correct country of origin has been determined on imports of aluminum and aluminum derivatives into the United States.

- Nonpayment of duties on products subject to the steel tariffs could result in severe monetary penalties.

- Consult with your procurement department to ensure that the correct country of origin has been determined on imports of aluminum and aluminum derivatives into the United States.

How Descartes Can Help

Effective and timely HS and HTS code lookup and related regulatory research are a challenge for many businesses that move goods across borders. As you can see, Harmonized System codes, duties, and tax rates change frequently, as do government regulations and policies relating to classification, valuation, and special trade programs and free trade agreements.

Descartes CustomsInfo™ Reference has an up-to-date database of more than 6 million regulatory sources covering 160+ countries. Its advanced global tariff code lookup and HS and HTS code search capabilities are accessed from a single-screen interface, helping import compliance professionals, attorneys, consultants and others make significantly better classification decisions more efficiently, optimize duty spend, as well as support classification determinations for audit purposes.

Descartes CustomsInfo™ Manager allows organizations to set up a central repository of product classification codes that can interface with multiple ERP, GTM, and ecommerce systems, as well as facilitate collaborative teamwork across departments, divisions and regions. With this solution, companies can also better prepare for HS and HTS code updates by pre-classifying ahead of time and going live with the changes when required.

Descartes Datamyne™ provides one of the world’s largest databases of global import-export trade data, giving businesses the ability to map their supply chains, identify new suppliers, monitor global trade trends, and leverage predictive analytics. By integrating this data, companies can proactively manage risks and make informed decisions to build more resilient supply chains.