By Laura Putnam-Ladley, Compliance Content Manager, Global Trade Intelligence, Descartes Systems Group

With the trade war between the U.S. and China on the center stage of international trade, it is easy to lose sight of other countries who have increased the usage of trade remedies to protect their domestic industries and have sought to reduce or remove regulatory loopholes that exempt importers from having to pay Customs duties and import taxes. Brazil is a leading example of this trend and one of the top five countries using antidumping regulations as a protective measure.

Reduced Ex-Tarifário Availability

The government in Brazil has been focused on re-industrializing the country’s economy and is using antidumping duties and countervailing duties to help facilitate this effort. In 2024, there were fifty-six antidumping duty cases, of which thirty-four resulted in Customs duties being imposed. The resulting tariff hikes in the steel and chemical sectors of the economy have led to the increased usage of the ex-tarifário (aka “tariff exceptions”). The Brazil ex-tarifário regime allows companies to import capital goods, information technology, and telecommunications goods at a temporarily reduced rate or full exemption if they lack equivalent national production in Brazil. The ex-tarifário is applied to a specific NCM (aka, HTS code) and a specific Customs product description and it can take two to four months for approval. Once granted, the tariff exception is valid for two years from the date of concession and can be renewed if the conditions at the time of concession have not changed.

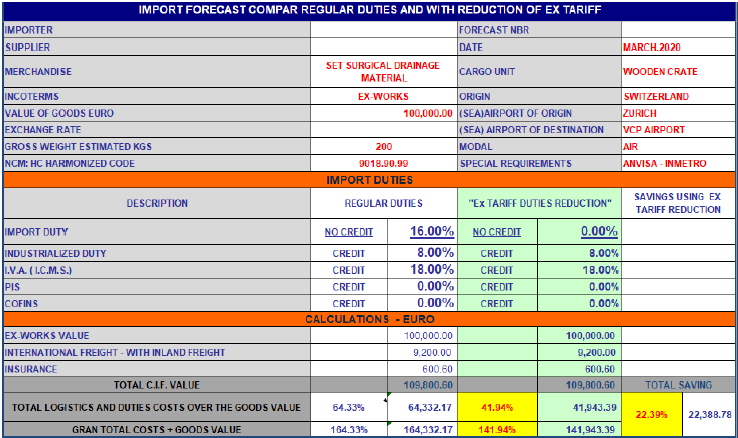

Fig. 1 An example of cost savings using the tariff exception for hospital drainage equipment which resulted in an immediate cost reduction of 22%.

Source: https://www.s-ge.com/en/article/expertise/20203-c7-brazil-import-tax-reduction?ct

Reductions in Exemption Availability

Due to recent regulatory updates, exceptions under the ex-tarifário regime have become harder to obtain. There is an application requirement in place for the inclusion of specifics for the “importer’s ‘investment project’ detailing the usage of the goods to be imported and potential gains with its acquisition”. Further complicating the application process is the provision of “more flexibility and tools for the Brazilian domestic industry to challenge tariff exception request for imported goods”. This has led to the reduction in approval of the tariff exceptions granted to Brazilian importers.

These regulatory updates have removed and added products from this tariff exception regime. Here are some of note:

- June 4, 2024 – Brazil recently added 454 items and removed 603 items from its list of foreign capital goods, information technology, and telecommunications goods subject to duty-free treatment under its ex-tarifário regime.

- August 8, 2024 – Brazil removed 168 tariffs under HS chapters 84, 85, 86, 87, and 90.

- September 19, 2024 – Brazil raised the import tariffs on 36 products under 31 six-digit tariff subheadings. These products were previously listed under the ex-tarifário regime for capital goods and now assessed duties ranging between 2.8 % and 11.2% (according to the WTO download facility).

- December 11, 2024 – Brazil repealed ex-tarifários for 164 Capital Goods and Computer and Telecommunication Goods.

The current trend of decreasing the number of approvals to use ex-tarifários along with the frequent changes of which products qualify under the ex-tarifários create additional challenges for global companies looking to mitigate the cost of duties assessed on the products they are looking to import into Brazil.

Here are the key considerations for global companies looking to reduce their shipping costs when importing their products into Brazil.

- Are your products subject to import duties in Brazil?

- Do any of your products fall under the tariff codes and Customs product descriptions that qualify under the ex-tarifário regime?

- Does your company meet the criteria for the tariff exceptions provided for under the ex-tarifário regime?

- How does your company monitor these frequent updates to the regulations that impact these tariff exceptions and duty increases for products that don’t qualify under them?

- Has your company looked at other ways to mitigate duty and import taxes assessed on your products such as free trade agreements (FTAs), foreign trade zones (FTZs), and other duty reduction/exemption programs?

How Descartes Can Help

Descartes provides automated solutions to assist your company in evaluating your shipping costs through HTS code searches and landed cost calculations. Descartes CustomsInfo™ Reference has an up-to-date database of more than 6 million regulatory sources covering 160+ countries. Its advanced global tariff code lookup and HS and HTS code search capabilities are accessed from a single-screen interface, helping import compliance professionals, attorneys, consultants and others make significantly better classification decisions more efficiently, optimize duty spend, as well as support classification determinations for audit purposes. We also offer solutions that can help with management of FTAs and FTZs, as well as high quality global trade content that enables businesses to perform trade-related activities more efficiently and accurately through their global trade management system, minimizing the risk of non-compliance and facilitating smooth global trade operations.