By Martin Meacock, Descartes, Director Product Management, Customs Europe

The biggest impact of the United Kingdom leaving the European Union will be because the UK will no longer be part of the EU Customs Union and because of the Single Market reintroduction of customs formalities after 27 years of free movement of goods.

However, the impact of Brexit goes much further afield, and not just for multinational companies operating in Europe.

On leaving the Customs Union, the UK will no longer be bound by the current EU external Tariff which it has used for almost 50 years. It will be free to set its own customs tariffs, trade defence measures and trade agreements which will affect all countries trading with the UK.

Post-Brexit UK Tariff Implications

The UK has already published its high-level customs tariff for imports where no preferential trade agreement exists.

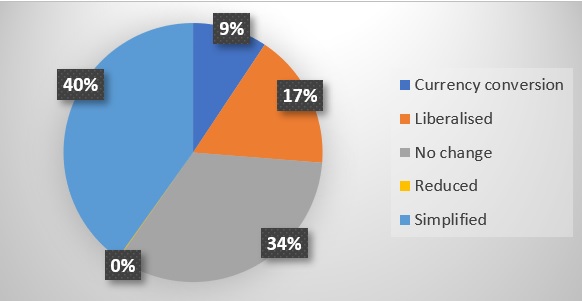

In many cases these have just been ‘Simplified’ by rounding down or ‘banded’ as follows:

- Tariffs under 20% have been rounded down to the nearest multiple of 2%.

- Tariffs between 20% and 50% have been rounded down to the nearest multiple of 5%.

- Tariffs above 50% have been rounded down to the nearest multiple of 10%.

Some product lines have been fully liberalized to zero although 44% of tariff lines have seen no change or have changed as a result of the tax being calculated in Pound Sterling instead of the Euro where the duty rate is based on weight.

Finally, no one will be sorry to see the removal of the EU meursing codes where duty was charged based on the sugar and milk content in processed foods.

Wider Brexit Impact on Tariff Classification

Not only will this tariff affect the duty rates applicable, but over time the Tariff Codes themselves will likely diverge from the EU’s Combined Nomenclature and TARIC codes.

From 1st January any Tariff Rulings issued in the UK will no longer be binding in the EU and the same for EU rulings in the UK. Whilst, like any ruling from a Customs Authority, they may be held to be persuasive in an argument of a particular tariff classification, the UK will no longer be bound by EU rulings or indeed classification opinions or interpretation.

The UK will now be free to adopt its own interpretation of tariff classification which may differ from that of the EU. For example a recent ruling to treat balloons with a LED and wording to identify an occasion as festive, carnival or other entertainment articles was noted as a change to UK practice as was the treatment of resistance or fitness bands as articles and equipment for general physical exercise.

Post-Brexit Free Trade Agreements (FTAs)

The UK has already sought to agree a number of carry over preferential or free trade agreements with which it already enjoys preferential trade via EU FTAs. So far these stand at approximately 20 and include countries and regions such as South Korea, the Southern Africa Customs Union, Israel, Central American countries and Chile. Some of the major agreements are still outstanding though, such as those with Canada, Japan, and Mexico.

The UK also continues to work on potential Free Trade Agreements with countries which do not currently have an agreement with the EU, such as Australia, New Zealand and the U.S.

Most importantly the UK has yet to agree a FTA with the EU.

Based on Q1 2020 UK figures, goods moving between the UK and the EU represented 47.5% of all UK Exports and 52.3% of its imports. In comparison for the first six months of 2020 the UK represented just 13.9% of EU exports and 9.6% of its imports, with movements within the EU representing over 40% of all EU trade. No wonder maybe then that the EU is very cautious of any agreements that would disrupt existing Free Trade Agreements and undermine the EU Single Market at the expense of a UK-EU FTA.

Failure to ratify a Free Trade Agreement not only impacts imports and exports between the UK and the EU but may also impact negotiations with other countries such as Norway and Iceland. It may also affect the UK External Tariff if they decide to reduce duty rates further or apply any temporary tariff suspensions, remember without a Free Trade Agreement then any unilateral reduced duty rates applied to the EU would likely be challenged by other countries at the WTO.

Origin Rules

Any preferential duty rates rely on Rules of Origin (RoO) to determine whether goods qualify or not.

Currently UK and EU materials are combined when determining if a product is considered as originating to benefit under an existing EU Free Trade Agreement. With the UK leaving the EU then unless there are changes to those existing EU Free Trade Agreements any UK Materials used in the manufacture of EU goods may lead them to no longer qualify for preferential rates of duties on import – an important point to consider if you sell or buy from the EU.

The UK has tried to mitigate this in their rollover agreements by agreeing where possible with the partner country to allow EU origin materials to continue to be considered as “originating” for the purposes of preferential origin without equivalent agreements or rules of origin.

This approach is relatively new and not guaranteed to be reciprocated by the EU or go without challenge, especially if the rules of origin or terms of the FTA diverge from the original EU FTA. A similar approach is used in the Pan-Euro-Mediterranean agreements which allows for diagonal cumulation of origin but that is only allowed providing all parties have corresponding FTAs with identical rules of origin but the UKs intention to use a so called extended cumulation goes much further.

For example, in the UK-South Korea agreement, both countries have agreed to allow, initially for 3 years, manufacturers to use EU originating materials without affecting their preferential origin status.

Therefore, it is critical that companies who rely on preferential rates of duties on goods shipped from the EU or UK confirm they are still eligible or risk facing an unexpected tax demand.

Trade Defence

Whilst a lot of discussion is on Free Trade Agreements and External Tariffs, the UK will also now have direct control over what goods and countries it decides to apply trade defence measures on.

These measures can include

- Anti-dumping: where a country is considered to be ‘dumping’ a product and injuring the importing countries domestic market.

- Anti-subsidy: where it is considered that subsidy payments by a country are harming fair competition.

- Safeguards: to protect certain domestic industries from a sudden and unexpectedly large increase.

So whereas the UK would have imposed EU trade defence measures based on injury across the EU, it will now decide which it wishes to keep, to protect UK producers, and whether any new defence measures are appropriate. This may mean new measures that would not have previously applied because the injury to the whole of the EU was not significant enough or not imposing measures where the UK experiences no injury.

Currently three existing measures will be transitioned anti subsidy and anti dumping measures on biodiesel from the USA and anti-dumping duties on PSC wires and strands from China.

As can be seen, Brexit is not just a European issue and any company trading with the UK or the EU need to ensure they have the latest data available both in terms of the new UK Tariff, UK and EU Free Trade Agreements and their respective Rules of Origin to be ready for any impact on the landed cost of goods and changes in regulatory requirements.

Mitigating the impacts of Brexit

What does Brexit mean for businesses? The different pieces that make up this complex picture demonstrate that time-consuming and resource-intensive work is required to correctly reassess tariff classification, duty rates and landed costs.

Online solutions, such as Descartes CustomsInfo, can help deliver quality classification determinations faster and more accurately, and in a format that can be used for options analysis and presentation to executives.