Streamline HTS Code Lookup and Import Compliance Processes

Stay Compliant With The Leading Provider of Global Trade Content and Harmonized Code Lookup Solutions

Utilize up-to-date content to make best-in-class HS/HTS classification decisions that meet international ‘reasonable care’ standards

Customs and international trade professionals know that trade regulations and tariffs change frequently. They also understand the need for accurate, up-to-date Harmonized System (HS) codes and related information. This is information that helps them calculate landed costs and ensure entries and declarations meet the ‘reasonable care’ standards of international customs agencies. This allows shipments to have a clear passage through customs authorities to reach their destination on time to the satisfaction of consignees.

Faster, More Accurate, More Reliable HTS Code Lookup and Import Compliance

- Up-to-date accuracy: Leverage timely and accurate information on HTS codes, duties and taxes, rulings, explanatory notes, and regulations and policies that are updated and maintained by a team of dedicated compliance experts.

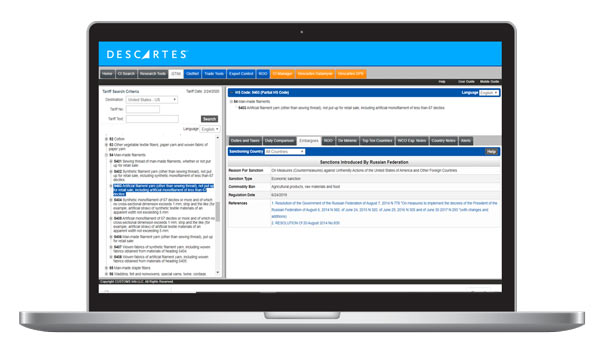

- Single-screen access to more than 6 million regulatory sources: Look up the HTS/HS codes and related international trade information you need from a unified, single-window interface.

- Productivity improvement: Our customers have reported significant productivity gains in classification work when using Descartes CustomsInfo.

- Reasonable care:Meet the ‘reasonable care’ standards of international customs agencies and better support HS classification determinations in the event of a government audit.

- Recordkeeping: Digitally store information in compliance with the minimum requirements and rules for each individual jurisdiction from the time of the import (or export).

Select the HS Code Lookup and import compliance solutions that best fit your business needs

Efficiently research classification, valuation, and special trade policies, regulations and programs

A Descartes CustomsInfo Customer Success Story

“From global trade content, denied party screening, … customs filings and a whole lot more, it all comes together in the Descartes platform. We’ve realized incredible efficiencies across the enterprise, enhanced our customer service, and enabled better visibility for our customers and partners. Descartes has really helped bring us to the forefront of the industry.”

Len James CFO John S. James Co.